How Can You Bring AI to the Banking Core Without Replacing IBM Systems? Discover how to integrate intelligent agents with AS400 and iSeries safely.

In many financial institutions, the very thing that keeps operations running is also what holds progress back.

AS400, iSeries, and other banking mainframe environments remain the backbone of the transactional core. Yet that same reliable, robust legacy becomes a barrier when the business demands automation, agility, and integration with artificial intelligence.

Today, modernization in banking is urgent. Customer expectations, regulatory pressures, and competitive dynamics leave no room to keep postponing change. The key question is no longer whether to modernize, but how to do it without putting what works at risk.

Empower your organization with custom AI agent development.

Schedule a meeting.

Backed by Data: The Journey Has Already Begun

Digital transformation in banking is not a future aspiration but a process already underway, backed by solid numbers.

According to Genesis Global’s 2025 Financial Playbook, more than 90% of global IT leaders have increased their budgets this year, focusing on modernization, automation, and artificial intelligence initiatives.

This trend is no coincidence: the idea that continuing to operate on outdated systems is costly and stifles innovation is spreading rapidly across industries.

McKinsey estimates that the strategic use of artificial intelligence in banking could generate up to $340 billion in annual value. This impact includes gains in productivity, operational efficiency, and new capabilities to interact with customers.

These figures confirm that technological modernization in banking is a decisive factor. However, day-to-day operations do not always evolve at the same pace.

In many institutions, legacy systems such as AS400, iSeries, or IBM i still sustain daily operations.

And while their reliability is unquestionable, they also present serious limitations when it comes to integrating new technologies.

Understanding what they are and how they work is the first step toward modernizing them without replacing them.

What “Legacy Systems” Mean in the Banking Context

Legacy systems are inherited technology platforms, developed decades ago, that still support critical processes in many organizations. In banking, the most common ones belong to the IBM ecosystem: AS400, iSeries, and the IBM i operating system.

How Did These Systems Evolve?

- AS400 was launched by IBM in 1988 as a robust and reliable midrange system.

- In the 2000s, it evolved into iSeries, with improvements in performance and connectivity.

- Later, IBM consolidated this line under the name IBM i, which today runs on Power Systems servers.

Although AS400 and iSeries no longer exist as active products, many institutions continue to operate adapted versions. That’s why it’s still common to hear those names when referring to legacy systems.

What Makes Them Hard to Modernize?

These environments use languages like RPG and COBOL and run through text-based interfaces known as green screens. They require specific commands from terminals such as 5250 or 3270, which limits day-to-day use to specialized technical roles.

Their architecture wasn’t originally designed to integrate with APIs, automated flows, or artificial intelligence models. That rigidity constrains their ability to adapt to today’s business demands, despite their operational reliability.

Are you assessing how to bring AI into your existing systems? We can help automate critical processes, connect modern solutions, and design a sustainable digital strategy.

Schedule a meeting with our team.

AI Agents as the New Interface for Legacy Systems

The integration of artificial intelligence agents in banking is reshaping how legacy systems are used. These agents, which understand natural language, can act as intermediaries between the customer and the core system.

For example:

- A chatbot can query the client’s actual balance in their IBM i system and display it in seconds.

- An AI assistant can execute a transfer or validate a claim by running flows defined in a configuration file, without human intervention.

- Testing teams can simulate real interactions with banking mainframes to validate new features, without relying on green screens.

This kind of integration replaces technical barriers with conversational flows, without modifying the backend.

Modernization Without Migration: How to Achieve It

Effective modernization doesn’t always mean migrating the entire architecture. Integrating legacy systems with new technologies is possible today if approached with precision and the right tools.

It can be achieved through:

- Intermediate infrastructure that connects AI agents with legacy systems safely.

- Structured modeling of operational flows, such as YAML files that describe interactions step by step.

- A culture of incremental change, where new solutions coexist with existing systems in short innovation cycles.

Comparison Table: Migration vs. Incremental Integration

| Strategy | Advantages | Risks | Estimated time |

| Complete core migration | Unified architecture, new standards | High cost, technical complexity | 12–36 months |

| Integration with AI and middleware | Low friction, quick return, continuity | Need for design and maintenance | 1–6 meses |

What is Middleware?

Middleware is software that acts as a bridge between two different systems. In this case, it allows modern AI agents to connect with IBM legacy systems without the need to rewrite the backend or modify the original system.

Typical Architecture in Progressive Modernization Processes

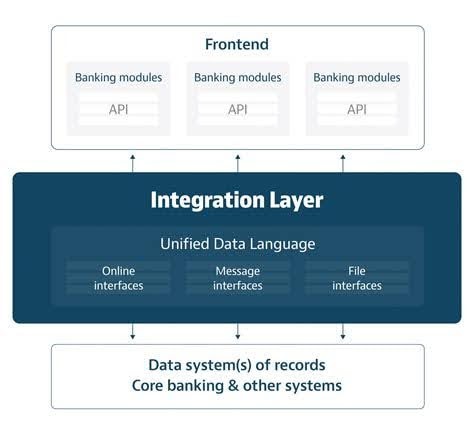

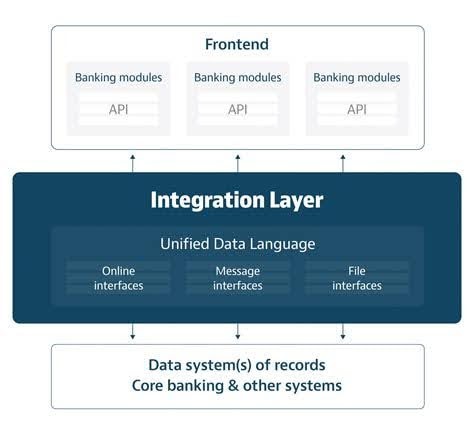

In this diagram, we illustrate a common approach to technological modernization in banking: the core system is preserved as the source of truth, while an integration layer is developed to translate and expose its logic through APIs and modern standards.

This layer acts as middleware: it unifies different interfaces (online, messaging, files) and allows frontend modules—such as mobile apps, portals, or AI agents—to operate without directly interacting with the legacy infrastructure.

This approach makes it possible to:

- Minimize risks: the core is neither altered nor directly exposed.

- Boost development speed: new modules can evolve in a decoupled way.

- Enable AI and automation adoption: through modern flows without green screens.

This pattern, compatible with strategies such as the strangler pattern, is key to advancing digital transformation in banking without disrupting critical operations.

Practical Case: Efficiency Without Migration

A regional bank implemented a conversational flow on its IBM i system using an AI agent connected through open-source infrastructure. In less than six months, it achieved:

- A 40% decrease in service times.

- A 30% reduction in support calls.

- A 25% increase in digital customer satisfaction.

All of this was possible without altering the legacy system or undertaking an expensive migration. These results show that modernization can begin with small flows that deliver real impact.

Concrete Case: AS400/iSeries MCP Server as an Open-Source Enabler

At Abstracta, we developed the AS400/iSeries MCP Server, an open-source tool that acts as middleware between IBM i systems and AI agents.

This server:

- Interprets YAML flows defined by the team and translates them into executable commands over TN5250 or TN3270.

- Allows an AI agent to operate as if it were interacting with a modern API, without modifying the core.

- Eliminates the need for green screens and reduces dependency on expert operators.

With solutions like this, legacy system modernization becomes a tangible possibility for banking. AS400/iSeries MCP Server is available on GitHub.

Access the repository here.

Modernization Means Connecting, Not Breaking

Innovation in banking doesn’t require eliminating what already works. It requires knowing how to connect legacy systems with new technologies, respecting the existing operational logic, and creating interfaces that unlock value.

Digital transformation in banking can start with a small conversational flow that exposes real data from the banking core. And that can make the difference between an agile operation and a missed opportunity.

Artificial intelligence in the banking core is already a reality. And it’s within reach for those who understand that to modernize also means to integrate.

FAQs about Banking Modernization and AI in Legacy Systems

What Is an AS400 System?

AS400 is a midrange system developed by IBM in 1988, designed to support critical business operations. Its evolution includes the names iSeries and IBM i, which today run on Power Systems hardware.

What Does It Mean to Modernize a Legacy System?

Modernization doesn’t always mean migration. It can involve wrapping the system with modern layers, connecting APIs, enabling AI agents, or automating tasks without changing the core.

What Are Green Screens?

This is the name given to the text-based interface used in terminals such as 5250 or 3270. These screens require technical commands to operate, which limits interaction for non-expert users.

What Is an AI Agent in Banking?

It’s an assistant powered by artificial intelligence that can interpret natural language instructions, make decisions, and execute actions on the bank’s systems.

Can AI Be Used Without Migrating the Core?

Yes. Tools like AS400/iSeries MCP Server allow AI agents to connect with legacy systems using YAML flows, without touching the core or compromising its integrity.

What Benefits Does This Integration Bring?

It enables process automation, reduces errors, exposes critical data in real time, and accelerates innovation—without losing the reliability of the legacy environment.

How We Can Help You

With nearly 2 decades of experience and a global presence, Abstracta is a leading technology solutions company with offices in the United States, Chile, Colombia, and Uruguay. We specialize in software development, AI-driven innovations & copilots, and end-to-end software testing services.

We help financial organizations modernize their operations. We do this by combining software development, continuous testing, and artificial intelligence tools applied to real business needs.

We believe that actively bonding ties propels us further and helps us enhance our clients’ software. That’s why we’ve forged robust partnerships with industry leaders like Microsoft, Datadog, Tricentis, Perforce BlazeMeter, Saucelabs, and PractiTest.

Our holistic approach enables us to support you across the entire software development life cycle.

If you want to explore how to connect AI agents with your legacy systems, automate key processes, or rethink your digital strategy, reach out to us to learn how we can help.

Follow us on Linkedin & X to be part of our community!

Recommended for You

Roadmap from Fintech to Banking: A Testing Perspective

Matías Fornara, Operation Manager at Abstracta

Related Posts

Context Engineering vs Prompt Engineering

Most enterprise AI teams struggle to move beyond demos. We help organizations design context-engineered AI systems that actually work in production, with software quality built in.

AI for Legal Professionals: Revolutionizing Law Firms

See how AI for legal professionals is transforming law firms with advanced analysis and cost reduction. Partner with Abstracta and start a new journey!

Search

Contents

Categories

- Acceptance testing

- Accessibility Testing

- AI

- API Testing

- Development

- DevOps

- Fintech

- Functional Software Testing

- Healthtech

- Mobile Testing

- Observability Testing

- Partners

- Performance Testing

- Press

- Quallity Engineering

- Security Testing

- Software Quality

- Software Testing

- Test Automation

- Testing Strategy

- Testing Tools

- Work Culture