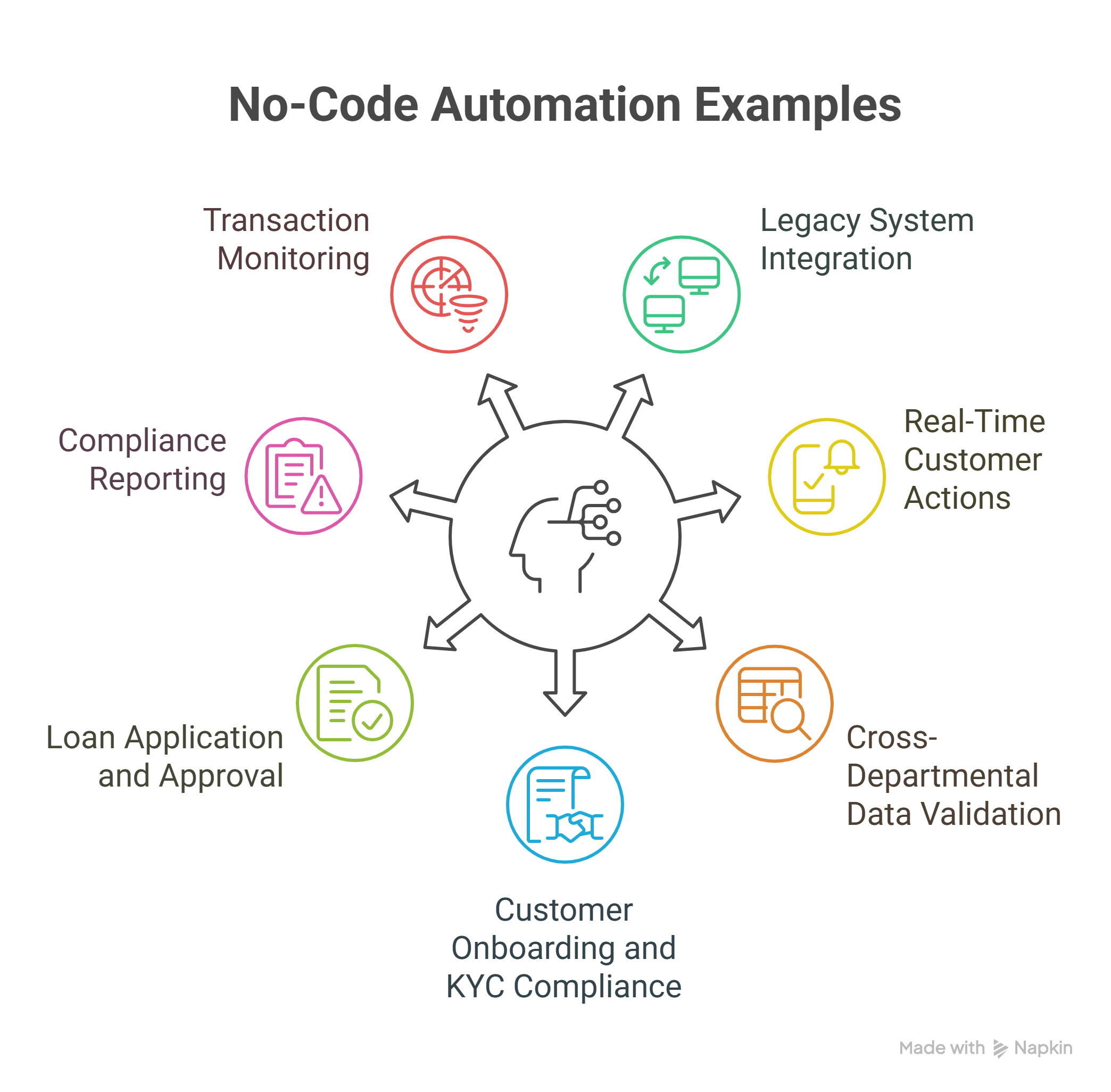

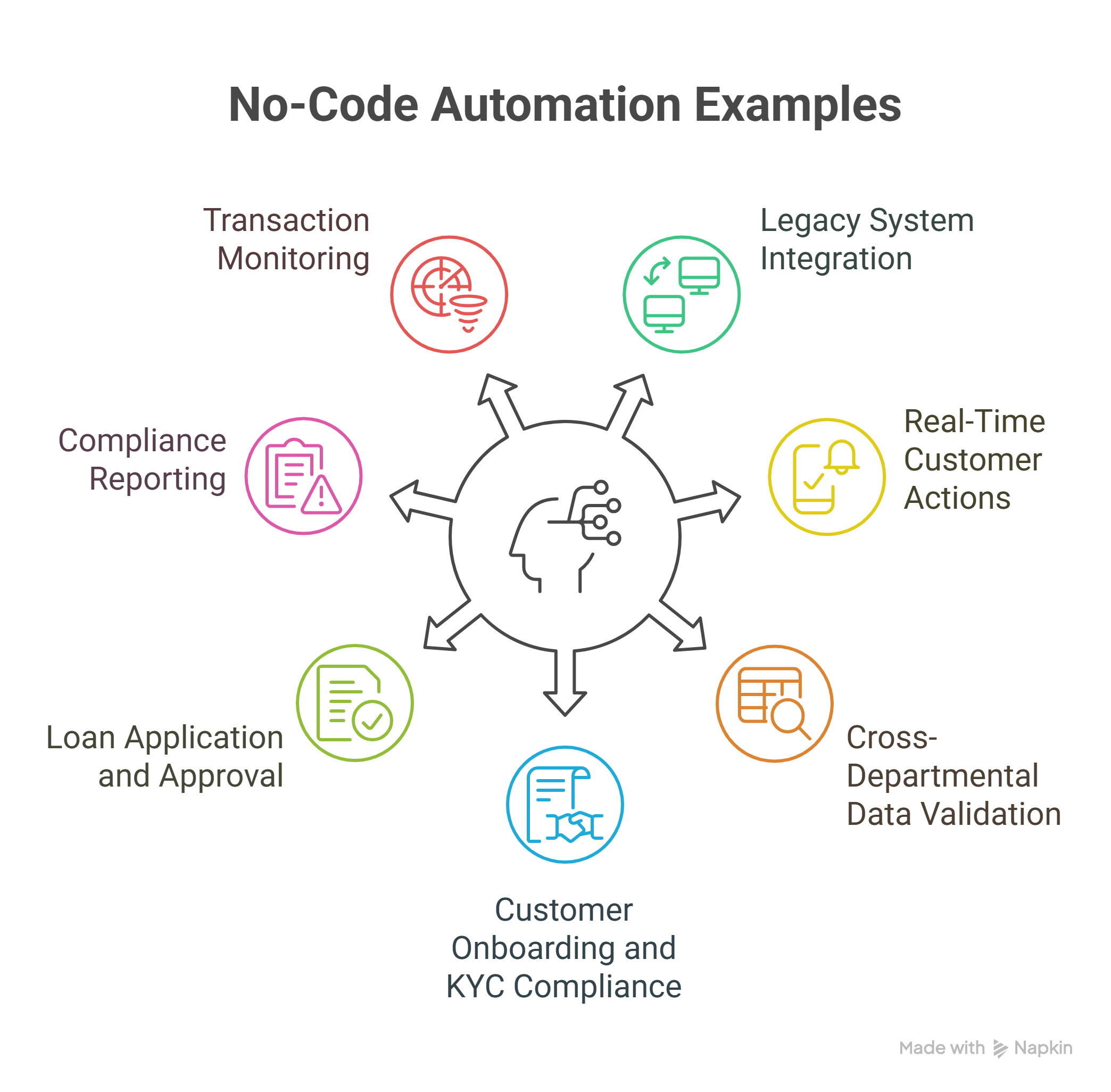

Real-world no-code automation examples for banking and fintech that show how teams reduce repetitive tasks, modernize legacy systems, and accelerate compliance.

In banking and fintech, many institutions are still held back by legacy systems and complex processes. No-code automation is helping businesses overcome these challenges, enabling faster decision-making, improved compliance, and enhanced operational efficiency.

The beauty of no-code solutions is that they allow enterprises to automate critical workflows without the need for a costly and time-consuming system overhaul.

In this article, we share real-world examples of how no-code automation can solve problems and drive value in the banking and fintech industries.

Did you know that internet banking is the fastest-growing channel in the financial services industry? Partner with a financial software development company providing secure, scalable solutions that prioritize speed and compliance.

Check our financial software development solutions.

No-Code Automation Examples for Decision Makers

1. Automating Legacy System Integration with AI

Many banks and fintechs still rely on legacy AS400/iSeries systems for critical operations, but these systems are often disconnected from modern technologies, slowing down processes and increasing the risk of errors.

Real-world example

A U.S.-based bank sought to modernize its AS400 system and improve automation across its legacy infrastructure. At Abstracta, we introduced a no-code automation solution that integrated AS400/iSeries MCP Server with the bank’s existing IBM i systems, our open-source product for connecting AI agents with AS400/iSeries systems

This solution allowed AI agents to automate processes like data entry, verification, and reporting, without the need to rewrite or replace the core system.

The integration enabled seamless automation of complex workflows, reduced operational errors, and sped up decision-making processes, while maintaining the stability and reliability of the bank’s legacy systems.

2. Automating Real-Time Customer Actions in Homebanking Platforms

Context:

Homebanking platforms are often filled with complex features that require customer input for tasks like setting up recurring payments, transferring funds, or managing account settings. Automating these actions in real-time helps customers complete tasks more quickly and easily, without requiring manual intervention from support teams.

Real-world Example

A major bank in Latin America wanted to improve its homebanking platform by automating user actions, such as scheduling bill payments, transferring funds, and updating personal details, all while maintaining a seamless user experience.

We implemented a no-code automation solution that integrated AI agents with the bank’s existing platform. This allowed the system to automatically carry out actions on behalf of the users, such as completing a transaction when the customer initiated a request.

With this solution, the bank was able to automate real-time tasks based on user behavior, significantly reducing the need for customer service involvement. The result was a 30% reduction in transaction processing time, a 25% decrease in customer service calls, and a 60% increase in customer satisfaction due to faster and more efficient services.

3. Automating Cross-Departmental Data Validation in Banking

In large banks, validating financial data across departments can be a lengthy process that involves manual checks, cross-referencing, and approvals. With no-code automation, banks can streamline this validation process by setting up workflows that automatically check data consistency and trigger alerts if discrepancies arise.

Real-world Example

A compliance team in a major Latin American bank, dealing with cross-border transactions and complex data regulations, needed to confirm that financial transactions complied with both internal guidelines and external regulations.

At Abstracta, we implemented an AI-powered automation solution that instantly validates transaction data against predefined criteria, reducing manual verification time and enabling faster compliance reporting.

Today, in a high-volume environment, this automation has led to a 50% reduction in compliance reporting time, resulting in faster decision-making and fewer compliance breaches.

4. Automating Customer Onboarding and KYC (Know Your Customer) Compliance

In fintech, customer onboarding and KYC compliance are often bottlenecks in the process. With no-code automation tools, fintech companies can streamline this process by integrating systems that automatically collect, verify, and process customer data.

Real-world Example

A fintech company in the U.S. needed to streamline its customer onboarding process while meeting KYC compliance requirements efficiently and accurately.

To address this, we implemented a no-code automation solution that integrated customer data management platforms, background check services, and email systems. This solution automatically verified identities, processed approvals, and notified the relevant teams, all within one seamless workflow.

As a result, the company reduced onboarding time by 40%, enabling them to onboard 50% more customers per month and significantly decreasing manual errors in the process.

5. Automating Loan Application and Approval Process

The loan approval process is highly manual in many banks and fintechs. No-code automation can automate the entire application lifecycle, from initial data entry to approval or rejection, without needing to overhaul the existing core systems.

Real-world Example

A U.S.-based fintech offering personal loans saw a rise in loan applications but faced delays due to the regulatory requirements of the Fair Lending Act and the manual process involved. It needed a way to speed up its loan application and approval process.

At Abstracta, we introduced a no-code automation system that seamlessly integrated with external data sources, such as credit bureaus and employment databases. This allowed the system to automatically verify financial history, credit scores, and income documents, minimizing the need for manual data entry.

Applications that met all conditions were automatically approved, while others were flagged for further review. This led to a 50% reduction in loan approval time, a 40% increase in the number of applications processed, and an overall improvement in the customer experience.

6. Automating Compliance Reporting in Financial Services

Compliance is a critical area for financial services firms, and failure to meet regulatory requirements can result in severe penalties. No-code tools can help automate compliance reporting, which often involves gathering data from various systems, generating reports, and verifying that reports meet regulatory standards.

Real-world example

One of our U.S.-based global banking clients needed to automate their compliance reporting process to meet stringent deadlines set by the Federal Reserve and improve accuracy in reporting required by Dodd-Frank, the U.S. regulation governing financial institutions and consumer protection.

We implemented a no-code automation solution that integrated their core banking systems with platforms like Airtable and Smartsheet. This solution automatically pulled data from multiple sources, generated real-time compliance reports, and submitted them to regulators, all without manual intervention.

As a result, the client reduced report generation time by 40%, streamlined their reporting process, and enabled greater accuracy, significantly lowering the risk of penalties due to missed deadlines or errors.

7. Enhancing Real-Time Transaction Monitoring in Banks

Banks face the challenge of monitoring transactions in real-time to prevent fraud and comply with anti-money laundering (AML) regulations. No-code automation enables banks to set up real-time monitoring systems that flag suspicious activities and generate alerts based on predefined rules.

Real World Example

Rising compliance expectations in Canada, particularly under FINTRAC’s AML regulations, forced a bank to overhaul its monitoring tools after several near‑misses in suspicious‑transaction reporting.

At Abstracta, we introduced a no-code automation solution that integrated real-time fraud detection tools with the bank’s existing systems. This solution automatically flagged unusual transactions and sent alerts to the security team for immediate action.

The implementation reduced response times by 35%, improved fraud detection accuracy, and helped the bank stay on top of compliance deadlines while simplifying their monitoring process.

The Benefits of No-Code Automation

In industries like banking, fintech, and enterprise management, no-code automation offers a scalable solution to streamline operations without disrupting legacy systems. It empowers non-technical users to automate business processes, improving efficiency, enhancing customer experience, and driving digital transformation.

By leveraging no-code platforms, businesses can:

- Improve Efficiency: Automate repetitive tasks and complex workflows with drag-and-drop interfaces and pre-built components, allowing business users to quickly create and manage workflows. This reduces manual input and improves team productivity.

- Reduce Costs: Cut down on the need for specialized developers by using no-code tools. Business users, even without technical knowledge, can create automated workflows, lowering development time and costs.

- Enhance Compliance and Security: No-code automation software helps businesses automate data handling, reporting, and compliance tasks. This leads to faster, more accurate regulatory fulfillment while maintaining robust security.

- Scale Operations Quickly: Adapt to market changes with business process automation workflows that can be adjusted easily. Automating processes enables businesses to respond rapidly without overhauling core systems.

- Enable Digital Transformation: No-code workflow automation empowers businesses to modernize without losing control of existing systems. By automating complex processes, companies can reduce errors and accelerate time-to-market for new products and services.

By using no-code automation, companies can drive their digital transformation, improve customer relationships, and maintain the reliability of their core systems.

Why No-Code Automation is Key Today for Senior Decision-Makers

The pressure to innovate is greater than ever, especially in industries like banking and fintech, where customer expectations are constantly evolving, and regulatory demands are increasingly complex.

In this context, no-code automation has become crucial for businesses that need to adapt quickly without the burden of extensive coding or IT resources. It allows companies to empower their teams, without technical expertise, to implement efficient solutions rapidly, automate workflows, and keep pace with digital transformation.

Today, businesses can’t afford to wait for lengthy development cycles. No-code solutions offer the flexibility to act fast, iterate quickly, and stay ahead of the competition while maintaining the reliability of their existing systems.

How Abstracta Can Help

At Abstracta, we specialize in helping enterprises integrate no-code automation to streamline their operations, enhance decision-making, and improve overall efficiency. From AI-driven solutions to regulatory reporting and fraud detection, our custom automation solutions are designed to meet the unique needs of the banking and fintech sectors.

Contact us to explore how no-code automation can help your business transform its operations.

FAQs About No-Code Automation in Financial Services

What Are Real No-Code Automation Examples in Banking and Fintech?

No code automation examples in banking include automating KYC, loan approvals, and compliance reporting using no code automation software and tools. These enable financial teams to automate tasks and enhance business operations without coding knowledge or disrupting existing systems.

How Does No Code Support Digital Transformation in Fintech?

No code supports digital transformation by enabling rapid deployment of mobile apps and automation solutions tailored to financial operations. This agility empowers teams to adapt business workflows without delays.

How Can No Code Automation Tools Modernize Legacy Banking Systems?

No code automation tools help integrate existing systems using drag and drop interface and integration capabilities, avoiding full system overhauls. This approach supports process automation and digital transformation in banking with minimal disruption.

What Is No Code Workflow Automation for Financial Institutions?

No code workflow automation enables the creation of automated workflows for repetitive tasks like data validation, onboarding, and compliance checks. It improves business workflows and reduces manual errors across complex business processes.

How Do Banks Use No Code Automation Platforms?

Banks use a no code automation platform to manage complex workflows such as fraud monitoring and real-time customer actions across multiple systems. This allows secure and fast automation of business process management without traditional development cycles.

What Role Does Business Process Automation Play in Fintech?

Business process automation in fintech simplifies client onboarding, compliance workflows, and customer relationship management using no code automation. It supports efficient project management and accelerates time-to-market.

How Is Robotic Process Automation Integrated into No Code Workflows?

Robotic process automation is combined with no code workflow automation to execute high-volume repetitive tasks in financial environments. This enhances automation journey speed and reduces operational risk.

Why Is Workflow Automation Crucial for Regulatory Compliance?

Workflow automation streamlines compliance reporting by automatically gathering and validating financial data from integrated systems. This fosters accuracy, reduces delays, and aligns with robust security features in the financial sector.

Can No Code Automation Improve Complex Workflows in Banking?

No code automation simplifies complex workflows like cross-departmental approvals and multi-step verifications. It allows banks to automate processes without needing deep coding knowledge or dedicated IT development.

What Are the Key Advantages of No-Code Automation in Legacy Systems?

The key advantages of no-code automation in legacy systems include the ability to modernize existing systems without disrupting core infrastructure. No-code platforms allow businesses to automate complex workflows and integrate modern tools with legacy systems, providing a cost-effective solution.

About Abstracta

With nearly 2 decades of experience and a global presence, Abstracta is a leading technology solutions company with offices in the United States, Canada, the United Kingdom, Chile, Colombia, and Uruguay. We specialize in AI-driven solutions development and end-to-end software testing services.

Our expertise spans across industries. We believe that actively bonding ties propels us further and helps us enhance our clients’ software. That’s why we’ve built robust partnerships with industry leaders, Microsoft, Datadog, Tricentis, Perforce BlazeMeter, Saucelabs, and PractiTest, to provide the latest in cutting-edge technology.

Embrace agility and cost-effectiveness through Abstracta quality solutions.

Contact us to discuss how we can help you grow your business.

Follow us on LinkedIn & X to be part of our community!

Recommended for You

API Monitoring for Large-Scale Systems

Leading the Shift to Agentic AI in QA: 10 Lessons for Enterprises

Sofía Palamarchuk, Co-CEO at Abstracta

Related Posts

Fintech Testing Guide

This guide can help you understand how to face the challenge of fintech testing holistically and with best practices.

Data Strategy in Financial Services: From Compliance to Reliable Decision-Making

Most strategies in finance fall short. This guide shows how to build a data strategy that supports AI, strengthens compliance, and creates measurable business value. A data strategy in financial services defines how institutions turn raw data into reliable, traceable insights. It aligns governance with…

Search

Contents

Categories

- Acceptance testing

- Accessibility Testing

- AI

- API Testing

- Development

- DevOps

- Fintech

- Functional Software Testing

- Healthtech

- Mobile Testing

- Observability Testing

- Partners

- Performance Testing

- Press

- Quallity Engineering

- Security Testing

- Software Quality

- Software Testing

- Test Automation

- Testing Strategy

- Testing Tools

- Work Culture