Most strategies in finance fall short. This guide shows how to build a data strategy that supports AI, strengthens compliance, and creates measurable business value.

A data strategy in financial services defines how institutions turn raw data into reliable, traceable insights. It aligns governance with business goals, supports AI adoption, and reduces operational risk.

Of course, the goal is to achieve control, but also clarity, confidence, and continuous value from every data-driven decision.

At Abstracta, we help banks and fintechs shift their data strategy from reactive to resilient. In this article, we’ll share what that transformation looks like: what works, what fails, and how different markets are evolving their data practices in response to regulation and AI pressure.

Need help testing your AI systems or validating data quality at scale?

We specialize in testing complex, data-driven platforms for banks and fintechs. Contact us!

The Real Risk Isn’t AI Failure. It’s Data You Can’t Trust

Financial institutions are investing at scale in AI, and that’s great—it means organizations have already understood the imperative need to use AI to offer competitive products. The problem lies in how they’re doing it, without a clear, structured data plan.

As a result, AI initiatives are built on unreliable foundations, where data quality, traceability, and validation are left behind.

Many still struggle to turn those efforts into real business outcomes. The problem is rarely the model itself. It’s the data behind it. Incomplete inputs, outdated sources, and missing lineage quietly undermine the entire system. When data can’t be traced, no insight is reliable, and no decision holds up under scrutiny.

Data observability addresses this by providing visibility into how data behaves, where it fails, and how it evolves over time. For banks and fintechs, it means faster audits and fewer compliance gaps.

The huge goal is reliability—under pressure, at scale, and when decisions depend on it.

A Modern Data Strategy Starts with Data Quality

Modern financial institutions no longer treat data strategy as a governance checklist. Instead, they approach it as a foundational system, aligned with measurable business outcomes.

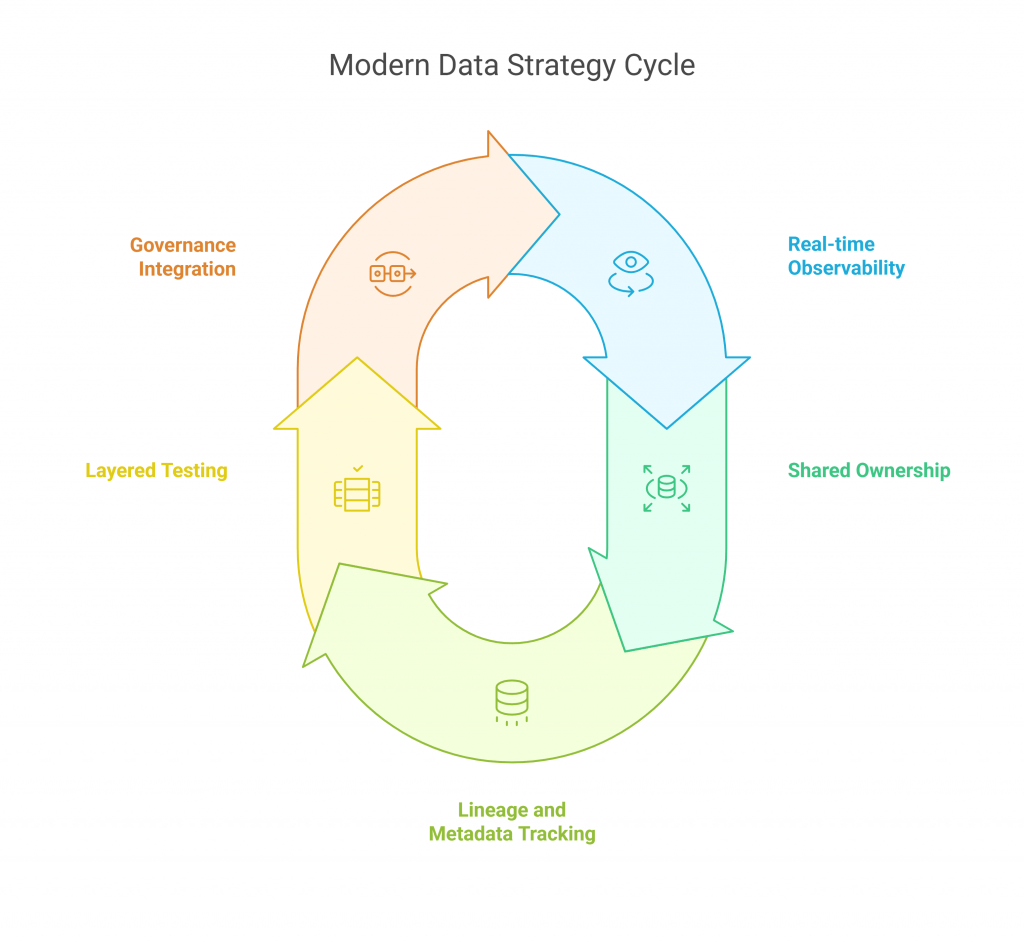

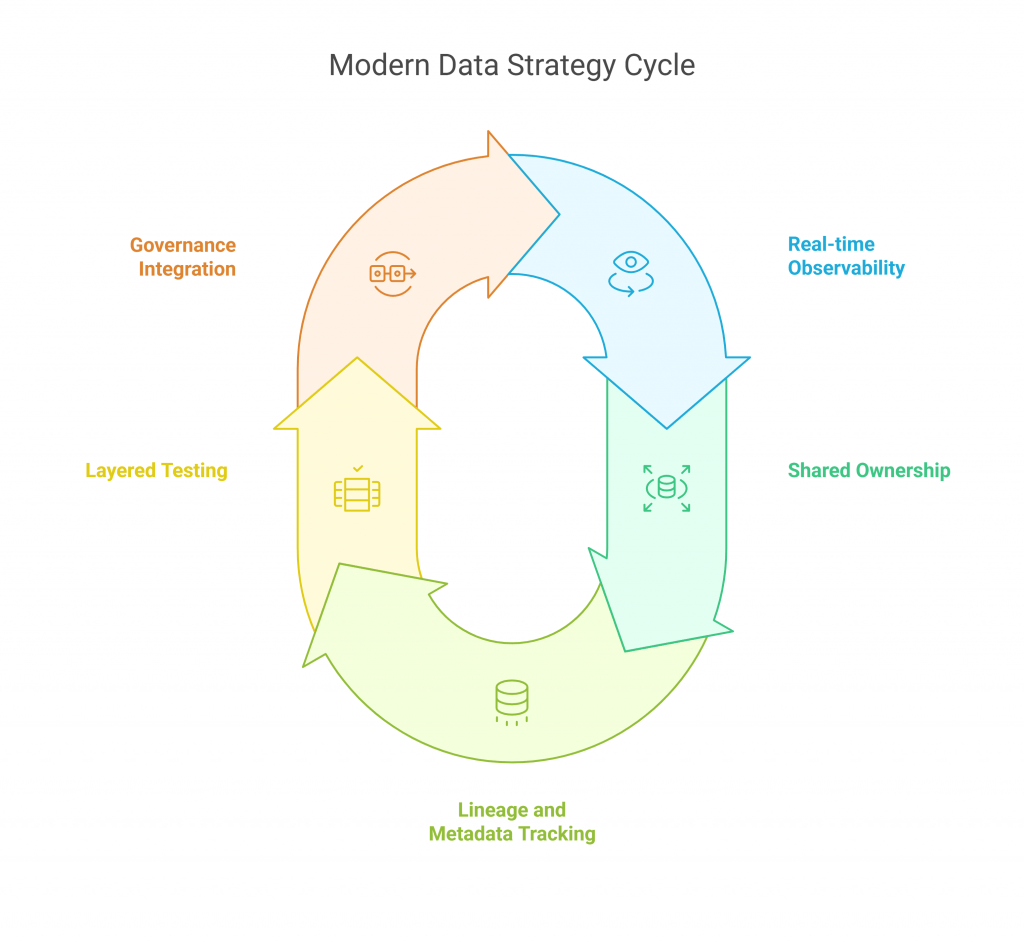

Here are five patterns we consistently see in institutions that get it right:

- Strategic data quality Approach: Quality culture driven by risk, impact, and business value. Leading institutions tailor data testing strategies by domain (financial, operational, and regulatory) to deliver data with proven integrity and adequate quality levels for confident decision-making.

- Governance that accelerates: When business rules, standards, data quality gates, and documentation are integrated into daily workflows, compliance becomes a source of clarity instead of friction. This allows faster releases and safer innovation.

- Shared ownership: Data quality is no longer the responsibility of one team. Business, compliance, and engineering collaborate to define quality standards and track them across the lifecycle.

- Layered testing: High-performing teams test not just software but also data logic, assumptions, and model behavior. This includes validation at ingestion, transformation, and prediction layers.

- Clear lineage and metadata tracking: Every input, transformation, and output is documented and accessible. This allows faster audits, easier debugging, and more reliable AI validation.

- Real-time data observability: Data pipelines are monitored for freshness, completeness, and anomalies. This enables teams to detect issues early, avoid cascading failures, and respond with confidence.

Abstracta & Datadog Professional Services

Accelerate your cloud journey with confidence! We joined forces with Datadog to leverage real-time infrastructure monitoring and security analysis solutions.

The CDO’s Role, But Not Alone

To move from strategy to execution, someone needs to own the operational side of data quality. In banks and fintechs adopting AI, that role increasingly falls to the Chief Data Officer. CDOs are responsible for maintaining data completeness, traceability, and continuous validation across systems.

But ownership isn’t enough. Quality must be built in and thoroughly tested. We’ve seen the most resilient teams involve engineering, compliance, and product in defining what “clean” means, when to test for drift, and how to respond to anomalies. Without this shared discipline, no data strategy holds under pressure. And no AI system performs reliably in production.

At Abstracta, we help organizations operationalize data quality through testing strategies tailored to complex, regulated environments like finance. Contact us!

Different Ways to Pressure-Test Your Data Strategy

Data is the backbone of every innovation, especially when AI is at the helm. For organizations aiming to leverage AI in software quality assurance, having a robust and reliable data strategy is a ticket to play in an AI-driven world. But how can leaders be sure their data strategy will hold up when faced with real-world demands?

Pressure-testing your data strategy provides that confidence. It uncovers hidden weaknesses, validates readiness, and enables your data governance and quality frameworks to sustain a long-term AI-driven strategy.

A 3-Level Maturity Model

Not all data strategies are created equal, and the maturity of your strategy can significantly impact your organization’s ability to leverage AI effectively.

- At the Reactive level, data processes are informal and often chaotic. Issues are addressed only after they cause disruptions, leading to inconsistent data quality and delays. AI adoption is minimal, making predictive insights unreliable. This exposes the organization to risks such as poor decision-making, operational inefficiencies, and increased costs due to error correction.

- In the Operational stage, data governance and quality controls become standardized and integrated into daily workflows. AI tools start boosting testing and monitoring, improving accuracy and reducing manual effort. However, gaps remain that can still cause data silos or compliance risks if not managed carefully.

- The Strategic level reflects a mature, proactive data culture where data governance aligns with industry standards like DAMA and ISO 5259. AI is deeply embedded, delivering a corporate AI agent hub offering predictive insights and enabling teams to anticipate and prevent quality issues before they impact users. The risks of data breaches, non-compliance, and faulty AI-driven decisions are significantly mitigated.

Pressure-testing your data strategy against this maturity model reveals vulnerabilities early, allowing you to build a resilient foundation that maximizes AI’s potential in software quality assurance

Red Flags You Shouldn’t Ignore

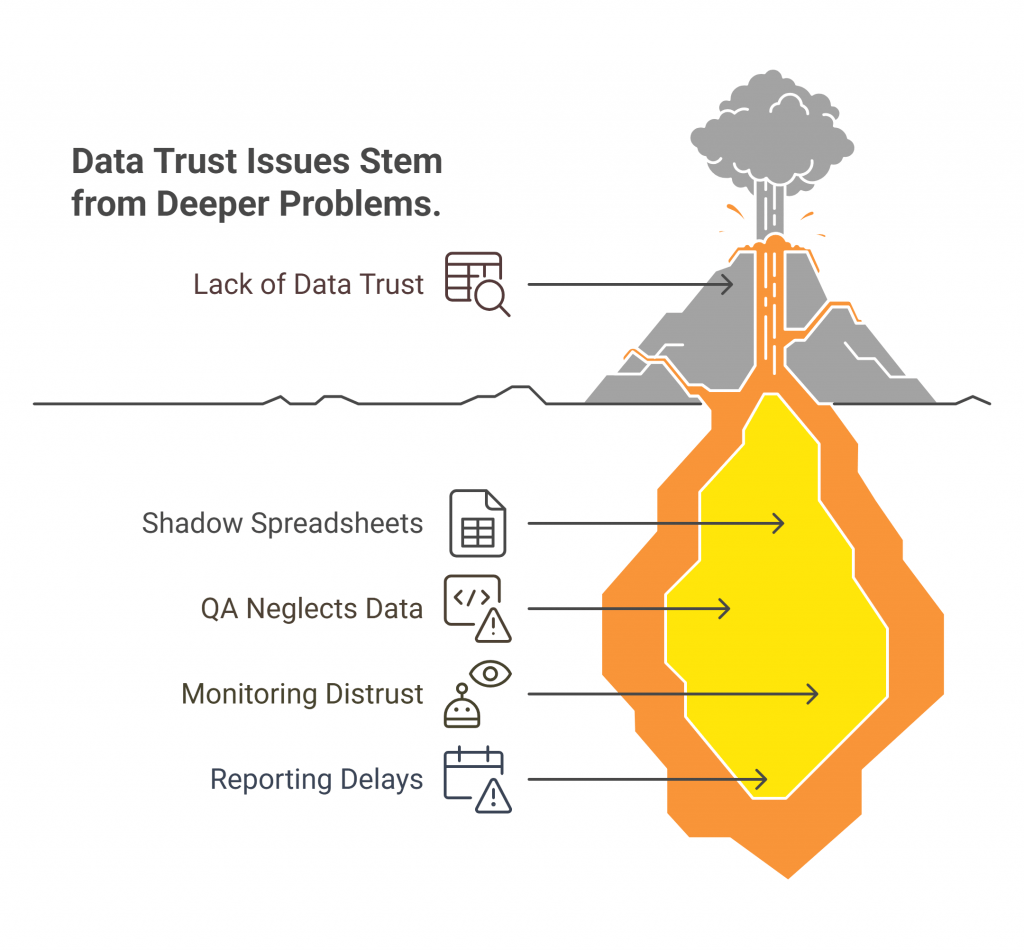

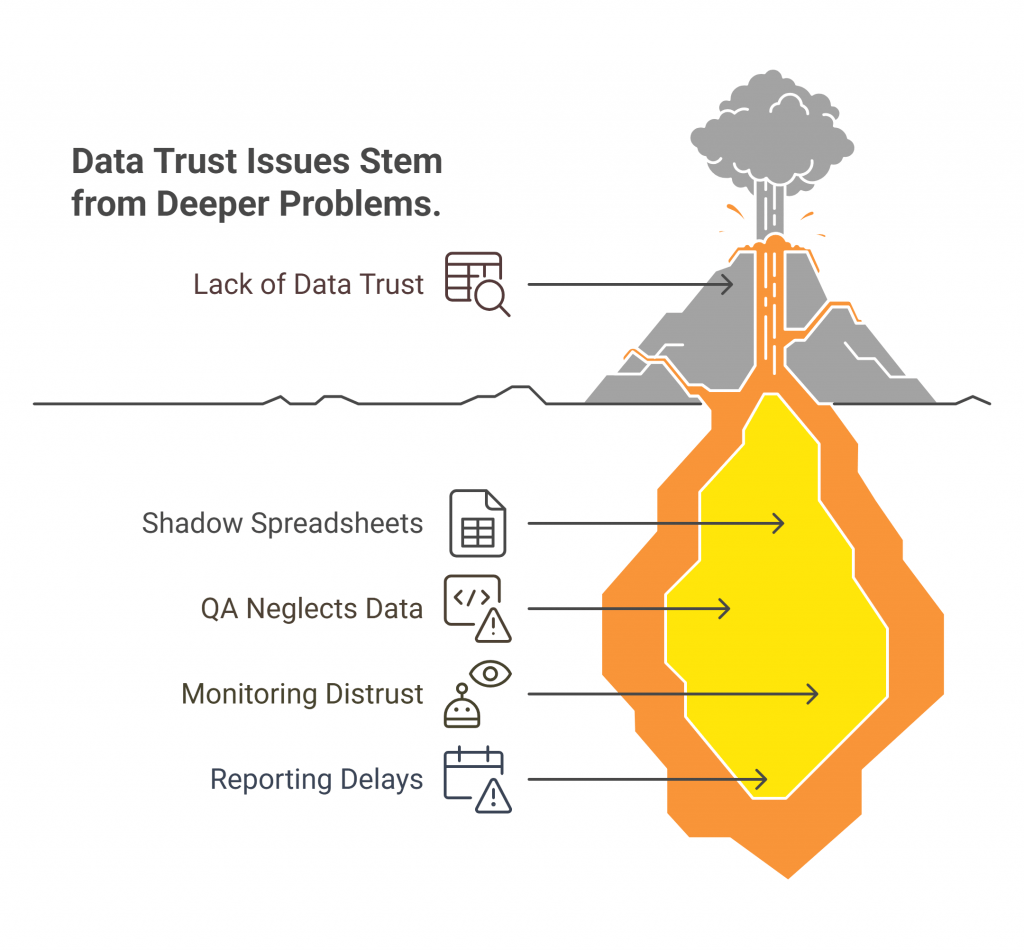

Data quality problems often reveal only a small part of larger underlying issues. Like a volcano, visible errors such as inaccurate reports or delays mask deeper risks:

- Shadow Spreadsheets: Multiple versions across teams lead to inconsistent, conflicting information, without centralized controls, errors proliferate unnoticed.

- QA Neglects Data: Testing that misses data validation.

- Monitoring Distrust: Incomplete monitoring can result in overlooked anomalies and hidden issues.

- Reporting Delays: Inefficient or slow data reporting processes create critical bottlenecks that hinder timely decision-making. This lag not only delays response to quality issues but also risks missed opportunities, increased operational costs, and reduced agility in a competitive market

Pressure-testing data quality means uncovering and fixing these hidden risks to boost reliable, consistent data that supports AI-driven quality assurance.

- You can’t trace a prediction back to its source

- Business teams rely on shadow spreadsheets

- QA focuses on code, not data

- Monitoring exists, but nobody trusts it

- Regulatory reporting takes weeks to compile

If two or more of these apply, your strategy needs reinforcement.

Interested in learning more? Better Your Strategy with Abstracta’s Software Testing Maturity Model

A Global Shift in Data Readiness

Around the world, financial institutions are redefining how they manage and validate data, not because they want to, but because they have to. Regulatory pressure, AI adoption, and market competition are converging into a new reality: data must be traceable, testable, and explainable.

- In Europe, years of PSD2 and GDPR enforcement have made traceability and auditability core requirements. Many institutions now treat data quality and observability as critical components of risk management.

- In Canada, the government’s Digital Charter and the pending Consumer Privacy Protection Act are pushing banks and fintechs to operationalize consent, transparency, and accountability. This shift forces organizations to embed testing and monitoring into the data lifecycle, not add it later.

- In the United States, the absence of a federal data strategy mandate creates inconsistency. Still, leading players are moving ahead, adopting observability and testing frameworks to meet internal audit standards and prepare for future AI governance.

- Across Latin America and Asia, some countries are embedding data validation and lineage requirements into their broader digital finance regulations. The pace varies, but the direction is clear: AI readiness starts with accountable data.

Download our ebook Canada’s Financial Shift!

Discover the key challenges shaping Canada’s financial sector.

Conclusion: From Strategy to Confidence

For banks and fintechs, data is the infrastructure that fuels AI and supports the decisions customers and regulators rely on. Modern data strategy is about empowering teams with clarity, enabling systems with reliability, and connecting the dots between data and value.

At Abstracta, we know how to blend compliance with velocity. How to translate quality principles into testable outcomes. And how to turn data strategy from behind-the-scenes theory into measurable business performance.

How We Can Help You

With over 16 years of experience and a global presence, Abstracta is a leading technology solutions company with offices in the United States, Chile, Colombia, and Uruguay. We specialize in software development, AI-driven innovations & copilots, and end-to-end software testing services.

We believe that actively bonding ties propels us further and helps us enhance our clients’ software. That’s why we’ve forged robust partnerships with industry leaders like Microsoft, Datadog, Tricentis, and Perforce BlazeMeter.

We work with banks and fintechs to turn data strategy into execution. That means helping teams design test strategies for AI systems, implement data observability, and validate the pipelines and models they rely on every day.

Whether you’re scaling generative AI, migrating critical systems, or improving data quality across teams, we can help you do it with confidence and proof.

Explore Financial Software Development Services!

Contact us to grow your business!

Follow us on Linkedin & X to be part of our community!

Recommended for You

Ebook Canada’s Financial Shift

Tags In

Related Posts

The Hidden Side of AI Adoption in Finance: “There’s No End-to-End Process Perspective”

Mario Ernst analyzes the structural mistakes that are leading financial institutions to accumulate proof-of-concept initiatives, isolated automations, and limited real impact from AI.

How We Unlocked Innovation Jointly with Microsoft AI Co-Innovation Lab

Dive into our transformative journey with Microsoft AI Co-Innovation Lab, where we set new standards for understanding systems, quality, and beyond.

Leave a Reply Cancel reply

Search

Contents

Categories

- Acceptance testing

- Accessibility Testing

- AI

- API Testing

- Development

- DevOps

- Fintech

- Functional Software Testing

- Healthtech

- Mobile Testing

- Observability Testing

- Partners

- Performance Testing

- Press

- Quallity Engineering

- Security Testing

- Software Quality

- Software Testing

- Test Automation

- Testing Strategy

- Testing Tools

- Work Culture