A detailed look at how automated bank systems are integrating automation into decision-making, operations, and legacy infrastructures, with real-world constraints and outcomes.

The architecture of many banking systems is mismatched with the way users expect services to work. Interfaces may allow real-time actions, but beneath them, processes still rely on scheduled jobs, manual approvals, and siloed data. The dissonance is not immediately apparent, but it defines how quickly a transaction settles, how errors are handled, and how decisions are escalated.

Introducing automation in this context is not a cosmetic upgrade. It requires redesigning how operations move across systems, how data triggers responses, and where human input is actually needed. Ultimately, it shifts the distribution of responsibility between technology and people.

Want to enhance secure digital transactions with performance that’s dependable and consistent?

Dive into our Financial Software Development Services!

The Core of the Automated Bank

The idea of automation in banking often defaults to surface-level improvements. But real change happens when systems can carry forward an action from input to outcome without stalling at each boundary.

In practice, this means defining what the system should recognize, when it should act, and how it should coordinate with external services, databases, or compliance checkpoints. A well-structured automation model doesn’t eliminate oversight. It reorganizes it, placing control at the right layers, with the right information available.

Example: Decision Execution Instead of Workflow Choreography

A customer applies for a loan. In a traditional setup, the application is routed to a reviewer, who checks documentation, consults policies, and escalates if needed. In an automated bank, the same request can be interpreted, validated, and evaluated against predefined rules without human intervention—up to the point where subjective judgment is required.

This shortens timelines but, going deeper, it also changes the nature of the process. The bank stops orchestrating every step and focuses instead on maintaining clear thresholds, traceable logic, and exception pathways.

Key Aspects of Automated Banking

Behind every effective automation initiative are structural decisions that determine how smoothly a bank can operate without delays, rework, or compliance gaps. These are the core architectural elements of a truly automated banking system:

- Integrated Execution: Front-end requests must trigger back-end actions in real time, without passing through queues or manual approvals.

- Context-Aware Logic: Systems should apply business rules based on transaction context, not just static templates.

- Layered Oversight: Controls must be embedded within processes, holding, flagging, or escalating based on data, not roles.

- System Interoperability: Automation must function across legacy systems, APIs, and third-party services without disrupting the core infrastructure.

These aspects define whether automation becomes operationally transformative or remains superficial.

Benefits of an Automated Bank

When automation is deeply embedded into banking systems, the benefits extend beyond cost reduction:

- Operational Efficiency: Fewer manual tasks, shorter processing times, and reduced dependency on scheduled jobs.

- Regulatory Alignment: Logic-driven oversight enables faster response to anti-money laundering and compliance requirements.

- Customer Experience: Faster onboarding, accurate account management, and real-time responses to customer requests.

- Scalability and Resilience: Systems handle volume without degradation, enabling growth at enterprise scale without rework.

Automation, when applied structurally, lets banks meet new demands while mitigating risks, and without losing the human layer where it matters most.

Automation Layers in Modern Banking Systems

Automated banks rely on multiple layers of technology that work in coordination, each solving specific constraints. Understanding these layers helps teams design realistic, scalable automation strategies.

Robotic Process Automation (RPA)

RPA simulates user actions in systems where no API or integration exists. It moves data, triggers interface-level actions, and bridges legacy systems. While effective for repetitive tasks, it lacks decision-making capacity.

Use case: Transferring form inputs between systems during account opening.

Artificial Intelligence (AI) and Machine Learning (ML)

AI and ML allow systems to learn from data, predict behaviors, and detect anomalies. They go beyond rules, helping banks optimize workflows dynamically.

Use case: Flagging suspicious transaction patterns in real time.

Natural Language Processing (NLP)

NLP powers assistants and chatbots that understand customer language. When connected to internal systems, they automate support and onboarding.

Use case: Interpreting customer requests via mobile device and executing utility bill payments.

API Integrations

APIs allow modular systems to exchange data cleanly. They minimize friction between services, reduce delays, and support seamless compliance monitoring.

Use case: Automating end-to-end loan processing between CRM, scoring, and approval modules.

Agentic Process Automation (APA)

APA enables systems to adapt actions based on evolving context. It extends automation to situations requiring real-time interpretation, such as cross-border data flows or exception handling.

Use case: Holding a transaction for compliance when financial records originate from a foreign country.

While structure and tools set the stage, true automation is tested when the system meets ambiguity. This is where interpretation—not just execution—becomes the limiting factor.

Integration Isn’t the First Barrier. Interpretation Is

The technical challenge in automation isn’t always wiring systems together. Most financial institutions already use middleware or API gateways. The actual friction starts earlier: when the system receives an input and doesn’t know what to do with it.

A user might type a transfer request through the app, or a payment arrives via the ACH network. The system must classify the intent, validate the data, and trigger the appropriate path. That’s where automation either moves forward or stalls.

From Inputs to Actionable Triggers

In an automated banking process, the interpretation layer matters as much as the execution layer. Natural language queries, structured forms, direct integrations—each must resolve into the same internal signal: an action the system can complete, log, and reconcile.

This requires more than rules. It needs trained components (some powered by machine learning, others by rule-based automation) that can match intent with valid next steps.

Monitoring, Alerts, and the Architecture of Fraud Prevention

In an automated bank, supervision isn’t layered on top of operations. It runs in parallel. Every request moves through a sequence of checks that interpret, score, and classify actions in motion. This structure enables control without delay.

Monitoring Transactions Without Lag

Monitoring transactions in real time allows the system to assess behavior, frequency, and value simultaneously. It’s not limited to fraud signals. It tracks execution consistency, flow integrity, and deviation from expected patterns.

Observability and continuous monitoring support every stage of the process. A failed transfer attempt, an unusual change in destination, or an access spike can all trigger an internal response without waiting for escalation.

Real Time Alerts and Dynamic Thresholds

Real-time alerts activate only when relevant. Volume-based thresholds, cross-device mismatches, and contextual rules define when the system intervenes. This reduces noise and preserves flow.

- A new mobile device triggers a review only if paired with location anomalies

- High-value ACH payments are flagged when exceeding historical averages

- Irregular frequency in transaction processing initiates secondary checks

These signals are prioritized and routed using advanced analytics.

Fraud Prevention Within the Pipeline

Fraud detection no longer operates as an isolated endpoint. It is integrated into the process flow:

- Artificial intelligence classifies intent based on transaction history

- Data security protocols check encryption and integrity at input

- Risk management logic adjusts based on customer profile and context

- Predefined actions help mitigate risks without delaying valid requests

Fraud prevention works not by rejecting transactions, but by containing risk before it escalates.

But monitoring alone doesn’t guarantee compliance. To meet regulatory requirements, oversight must be embedded directly into the execution logic.

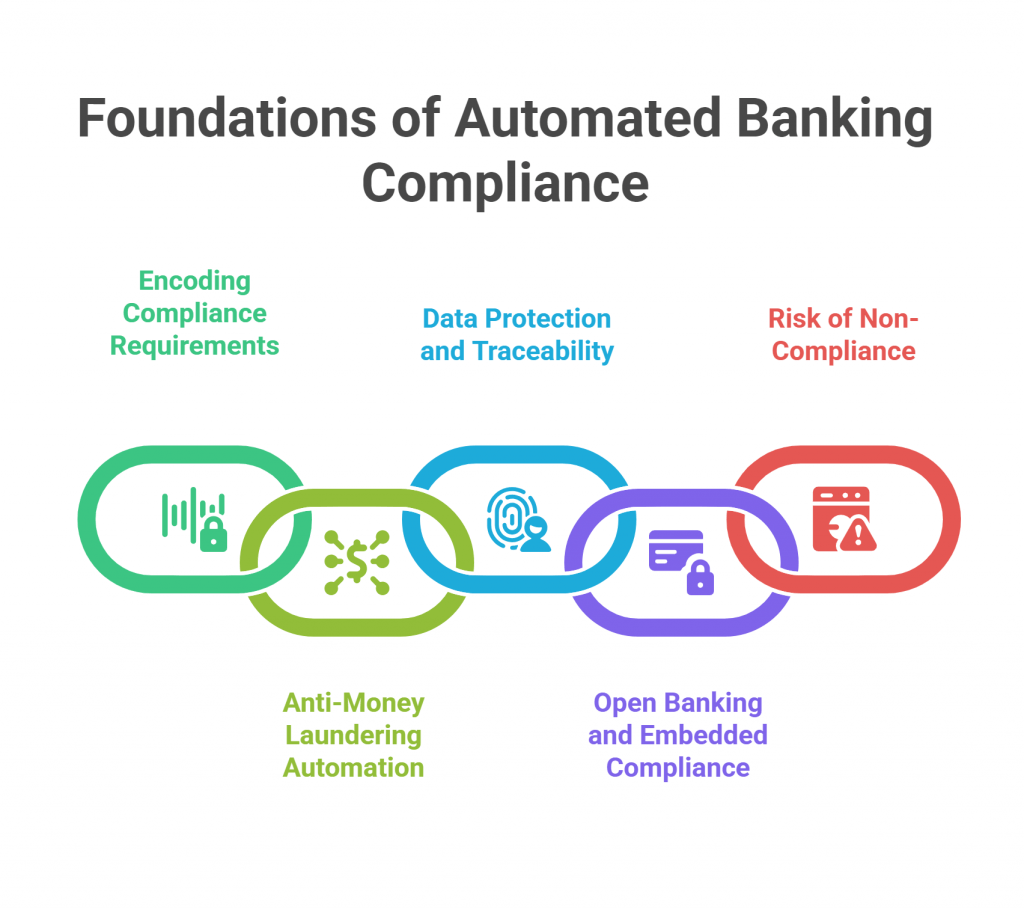

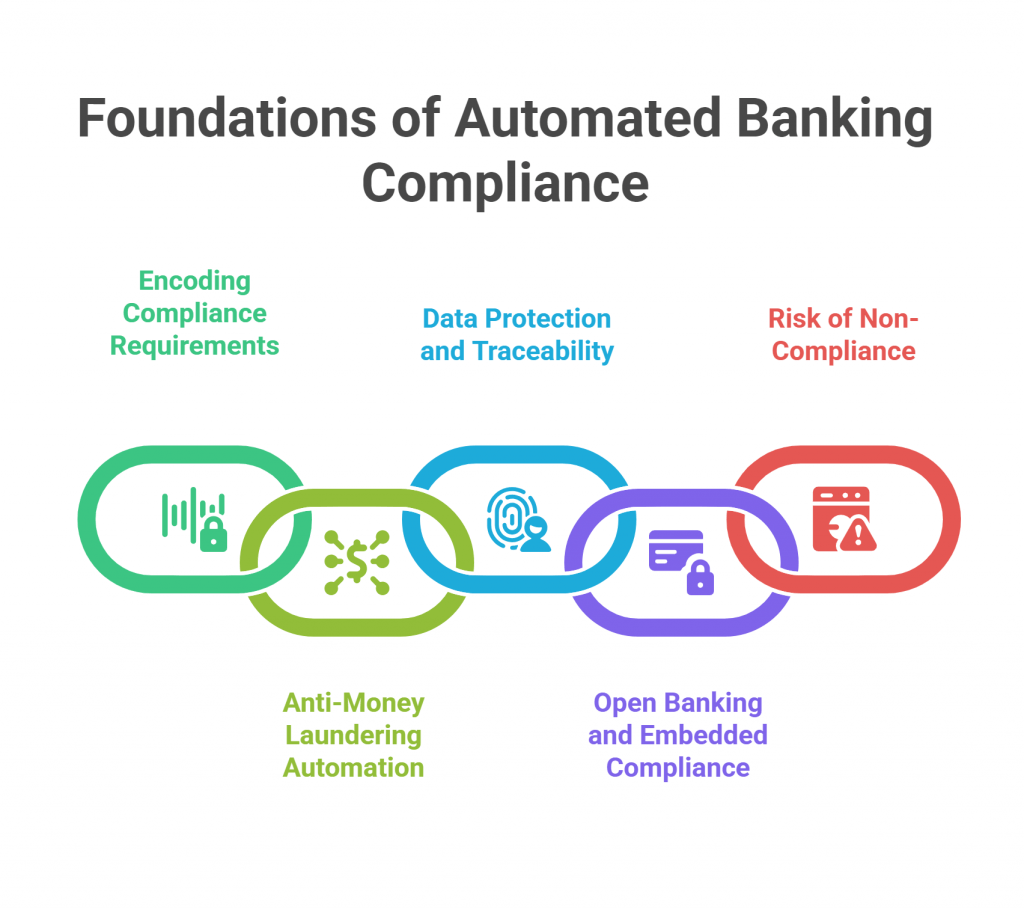

Regulatory Compliance by Design

For automated banking processes to scale, regulatory compliance must be enforced within the execution path, not as a separate layer of review. This shifts compliance from a checklist to an embedded behavior.

Encoding Compliance Requirements into Logic

Rather than delegating interpretation to staff, automated systems enforce compliance requirements through machine-readable rules. These can include:

- KYC validations based on real-time data

- Threshold alerts for high-risk financial transactions

- Blocking transfers from or to flagged entities in a foreign country

Each of these validations runs as part of the execution, not after it.

Anti-Money Laundering Automation

Anti money laundering frameworks depend on identifying patterns across accounts, timeframes and behaviors. Automation enables this by:

- Cross-referencing current actions with historical flags

- Detecting structuring techniques or volume anomalies

- Holding suspicious transfers before funds move

This requires continuous monitoring, not batch reviews.

Data Protection and Traceability

Data encryption enables customer data and transaction details to be secured both in transit and at rest. But automation also contributes to traceability:

- Every action is logged with timestamps and triggers

- Monitoring transactions produces a trail that supports internal audit and external inquiry

- Systems maintain lineage between customer input and regulatory decision points

Open Banking and Embedded Compliance

In open banking environments, institutions must expose customer data through secure APIs while complying with consent, audit, and data minimization regulations. Automated systems handle:

- Consent management and versioning

- Real-time validation of third-party requests

- Continuous logging for audit compliance

Embedding these validations into the process, not layered externally, is essential for trust, scalability, and regulatory alignment.

The Risk of Non-Compliance

Failure to automate compliance exposes institutions to non-compliance penalties, operational disruptions, and reputational damage. It also slows down legitimate operations, forcing extra checks even in low-risk cases.

Designing compliance into the process avoids this. It enables fast, secure execution without sacrificing control.

While most automation projects focus on scale and performance, some deliver measurable impact in inclusion, accessibility, and digital trust. In the next section, we share how we apply those principles in practice.

Automation With Social Impact: The Copiloto BROU eBanking Case

Not every automation initiative focuses solely on scale or efficiency. Some prioritize accessibility, clarity, and direct value for users navigating complex systems. This was the vision behind a new initiative selected for development by BROU bank and the National Agency of Research and Innovation (ANII) at Uruguay: to build a digital assistant that truly supports every banking customer, with Abstracta as the technology partner.

A Generative AI Solution Designed for Real People

The Copiloto BROU eBanking is a generative AI assistant that will help users complete everyday banking operations, intuitively. This solution, set to be integrated into eBROU’s digital platform and mobile app, is designed to assist users with tasks such as:

- Paying utility bills

- Making transfers

- Checking account balances

- Handling routine inquiries

Interaction will be possible via text or voice, enabling more accessible digital experiences across all age groups and levels of tech familiarity.

Increasing Accessibility and Autonomy

The assistant focuses especially on people who need more guidance when interacting with digital services, whether due to age, limited experience, or lack of familiarity with financial terminology. By providing contextual help and guiding users step by step, it aims to increase autonomy while reducing operational costs.

A Joint Effort Toward Inclusive Innovation

This project was selected for funding and development as part of the challenge “Improving Payment Methods in Personal Banking“, led by BROU and ANII. Its impact lies not only in technological advancement but also in aligning with regulatory requirements and integrating seamlessly with existing systems to boost practical, scalable adoption.

In a Nutshell – Automated Banking

Automated banking is not about replacing manual processes with faster versions but redesigning how requests become outcomes—across systems, teams, and compliance rules. When automation runs at the execution level, it improves accuracy, reduces latency, and adapts to scale without increasing risk.

At Abstracta, we help financial institutions implement automation that respects existing systems and regulatory frameworks, while transforming how services reach people. From customed AI Agents to end-to-end transaction automation, we support banks in delivering technology that performs and serves.

Key Takeaways

- Banking automation technology must operate at the execution level to drive measurable outcomes.

- The financial services industry is shifting from task-based digitization to fully integrated automation.

- Providing customers with faster, simpler services requires aligning back-end automation with front-end systems.

- The banking industry must embed compliance and fraud detection into automated flows, not layer them on.

- Smart automation reduces repetitive tasks and elevates customer experience through more responsive systems.

FAQs about Automated Bank

What Is an Automated Bank?

An automated bank uses systems that process customer requests without manual intervention. These systems can interpret inputs, apply rules, and complete actions like transfers or account changes, all within defined controls. This improves speed, reduces errors, and scales operations without increasing staff load.

What Is Banking Automation?

Banking automation refers to the use of technology to handle routine financial services. It includes tools like robotic process automation, rule engines, and AI systems that manage account updates, payments, or compliance tasks. The goal is to improve efficiency, accuracy, and customer satisfaction.

What Is Autonomous Banking?

Autonomous banking extends automation by allowing systems to make decisions based on data without waiting for human input. This includes monitoring transactions, identifying fraud risks, adjusting limits, and processing loans. Oversight still exists, but it’s integrated into the system flow, not separated.

What Is ACH Bank?

An ACH bank participates in the Automated Clearing House network, which handles electronic transfers like direct deposits and utility bill payments. ACH payments move between receiving depository financial institutions and originate from bank accounts, often as part of automated processing pipelines.

What Are the Main Technologies Driving Banking Automation Today?

Key technologies include robotic process automation, natural language processing, artificial intelligence, and machine learning. Together, these tools streamline operations, improve customer experience, and help meet compliance requirements while reducing human error and operational costs.

How Does Banking Automation Improve Accuracy and Reduce Errors?

Automation reduces errors by removing manual steps prone to misentry or delay. Systems validate customer data, enforce policy rules, and flag inconsistencies in real time. This not only prevents mistakes but also supports data security and regulatory compliance more consistently.

In What Ways Can Automation Cut Operational Costs for Banks?

Automation reduces repetitive work, improves speed, and limits the need for rework. Tasks like data entry, document checks, and transaction monitoring become faster and more accurate. This lets staff focus on higher value tasks and reduces support overhead at enterprise scale.

How Do Integrated Platforms Simplify Implementing Banking Automation?

Integrated platforms centralize tools, policies, and monitoring. This makes it easier to introduce automation without disrupting existing systems. By linking components through a control layer, banks can automate selectively and scale gradually without losing traceability or compliance alignment.

How Does Banking Automation Technology Support Customer-Facing Operations?

Banking automation technology connects core systems with user interface elements, allowing real-time execution of customer requests. By automating routine decisions and validations, banks improve response times, reduce manual steps, and enable services to align with customer expectations and operational integrity.

What Role Does Data Analysis Play in the Financial Services Industry?

In the financial services industry, the ability to analyze data drives everything from fraud detection to loan approvals. Automated systems use this insight to adapt decision rules, personalize services, and meet compliance requirements, reducing risk while improving accuracy across the banking value chain.

How Do Automation Tools Enable Banks to Reduce Risk and Costs?

Automation solutions enable banks to process large transaction volumes with accuracy, providing immediate access to services, driving cost savings, and supporting proactive risk mitigation through real-time control.

How Can the Banking Industry Improve Customer Experience Through Automation?

The banking industry improves experience by using automation to simplify processes and minimize repetitive tasks. This allows institutions to focus on providing customers with responsive, secure services while freeing human agents to handle complex needs that require empathy or judgment.

How We Can Help You

With over 16 years of experience and a global presence, Abstracta is a leading technology solutions company with offices in the United States, Chile, Colombia, and Uruguay. We specialize in software development, AI-driven innovations & copilots, and end-to-end software testing services.

We believe that actively bonding ties propels us further and helps us enhance our clients’ software. That’s why we’ve forged robust partnerships with industry leaders like Microsoft, Datadog, Tricentis, and Perforce BlazeMeter.

Our holistic approach enables us to support you across the entire software development life cycle.

Explore our Financial Software Development Services and contact us to grow your business!

Follow us on Linkedin & X to be part of our community!

Recommended for You

Open Banking: The API Opportunity for Fintech and Banks

Anti-Money Laundering in Canada: From Risk to Readiness

What is Functional Testing? Types, Strategies, and Automation

Tags In

Sofía Palamarchuk, Co-CEO at Abstracta

Related Posts

Automated Accessibility Testing: Comparing axe + WDIO and Pa11y-ci

Let’s dive into accessibility testing! We will explore efficient and effective tools that enhance website accessibility. Our goal is to evaluate their capabilities and coverage based on accessibility standards and learn what the best tool for which task is. Get insights and strategies for incorporating…

How to Optimize Test Coverage in the Long-Term

Our method for improving test coverage over multiple test cycles We want to test as much code as humanly (or mechanically) possible right? Yes and no. For each test cycle, it’s important to consider multiple strategies for measuring test coverage and to put a system…

Search

Contents

Categories

- Acceptance testing

- Accessibility Testing

- AI

- API Testing

- Development

- DevOps

- Fintech

- Functional Software Testing

- Healthtech

- Mobile Testing

- Observability Testing

- Partners

- Performance Testing

- Press

- Quallity Engineering

- Security Testing

- Software Quality

- Software Testing

- Test Automation

- Testing Strategy

- Testing Tools

- Work Culture